Key findings of this memo can be summarized as follows:

- Oil sand producers must remain conscious of US monopsony power.

- US tariff schemes present major downside risk for Canadian producers.

- Existing infrastructure matters (i.e., maintenance of transportation and refining assets in Canada and the US will extend the life of oil sand production).

- Diversification of offtake will require greenfield infrastructure projects and willing buyers of heavy crude.

Introduction

Oil sands are one of the most unique, abundant, and complex deposits of oil on the planet. The highly viscous, semi-solid blend of sand, clay, water, and bitumen accounts for roughly 9% of global proved oil reserves1. Creating value from the substance requires processing and extraction methods found nowhere else on the planet. The bespoke nature of the technology and processing makes bitumen a high cost, carbon intensive oil with complex environmental impacts. In a world aware of the climate impact of oil consumption and actively seeking fossil fuel alternatives, the position of oil sands as the world’s highest cost marginal producer is perhaps a precarious one.

Many experts foresee an eventual decline in oil sand production in which market share is conceded to low cost, low carbon intensity producers such as OPEC. Factors unseen to date such as a sustained decline in global oil demand and financial penalties tied to carbon intensity would in theory drive this change. Still, predicting the timing, pace, and ultimate beneficiaries or casualties of this shift remains challenging

Take wood and coal for example. In terms of percentage share of total global primary energy consumption wood and coal peaked long ago. Wood accounted for 98% of all primary energy consumption in 1800 and has declined ever since 2. Coal peaked as a percentage share in the early 1910s and has likewise declined. Yet, both resources have seen absolute consumption continue to climb due to expanding global energy demand (i.e., the energy consumption pie has gotten bigger). According to the Statistical Review of World Energy, the year 2024 saw the most coal consumed in recorded history and twice as much wood consumed (for energy purposes) than 120 years ago3.

Absolute consumption growth globally does not necessarily mean winners globally. Global growth in coal consumption has been concentrated in China, India, and Indonesia. In fact the growth in these markets has been so strong it has masked large declines in western nations’ coal consumption. The post-mortem for coal in the western world is complicated with governmental, market, and environmental factors all contributing but reflects the lumpy distribution of winners and losers. Similar trends are observed in historical trends for wood consumption.

With this context in mind, the long term viability of Canadian oil sands is examined. The goal is not to predict the future but rather explore the factors influencing this abundant resource’s future as an energy source. Factors such as, infrastructure, regional demand, diversification of buyers, and geopolitics will be considered in this memorandum.

Infrastructure & Regional Demand

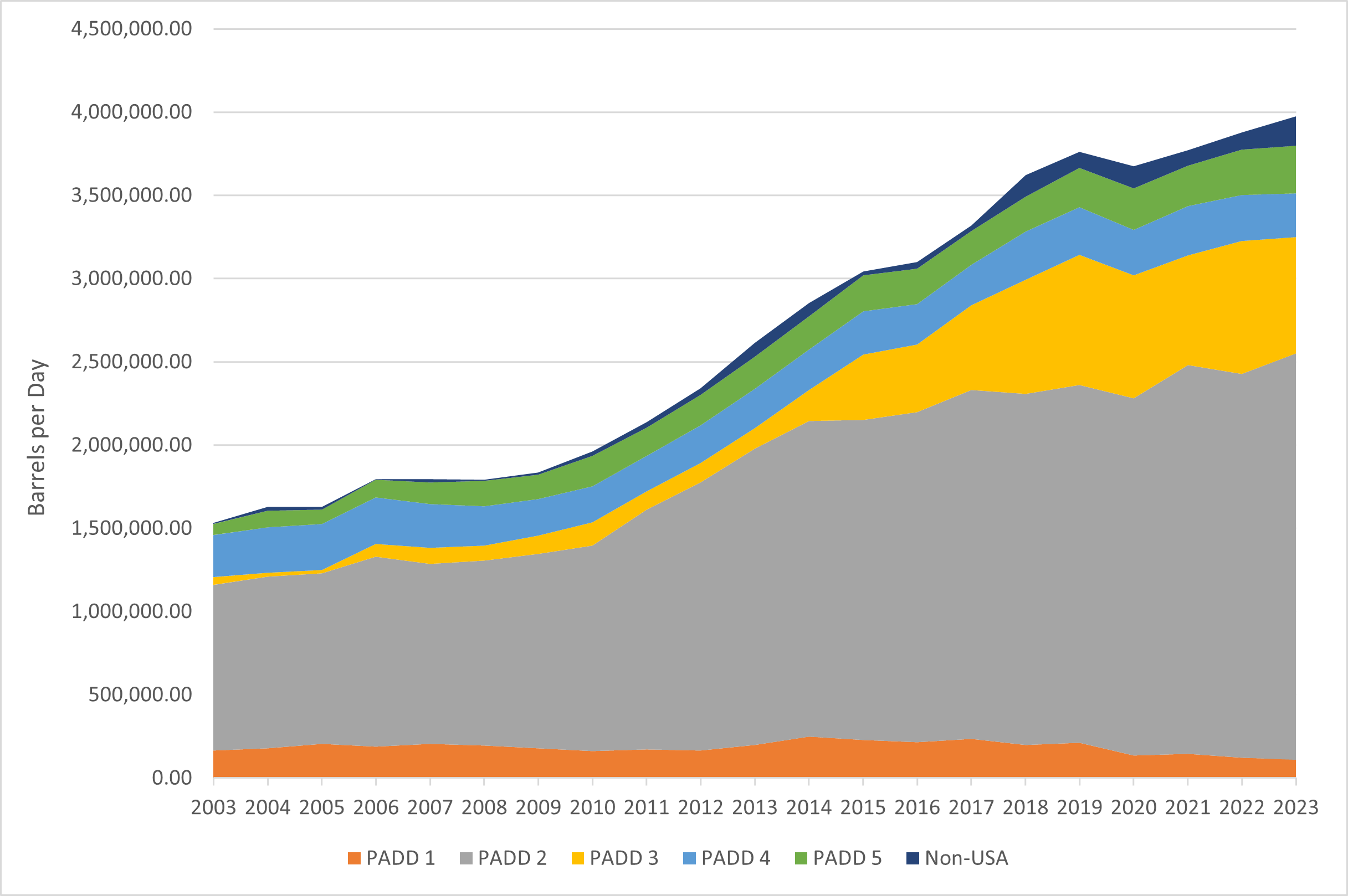

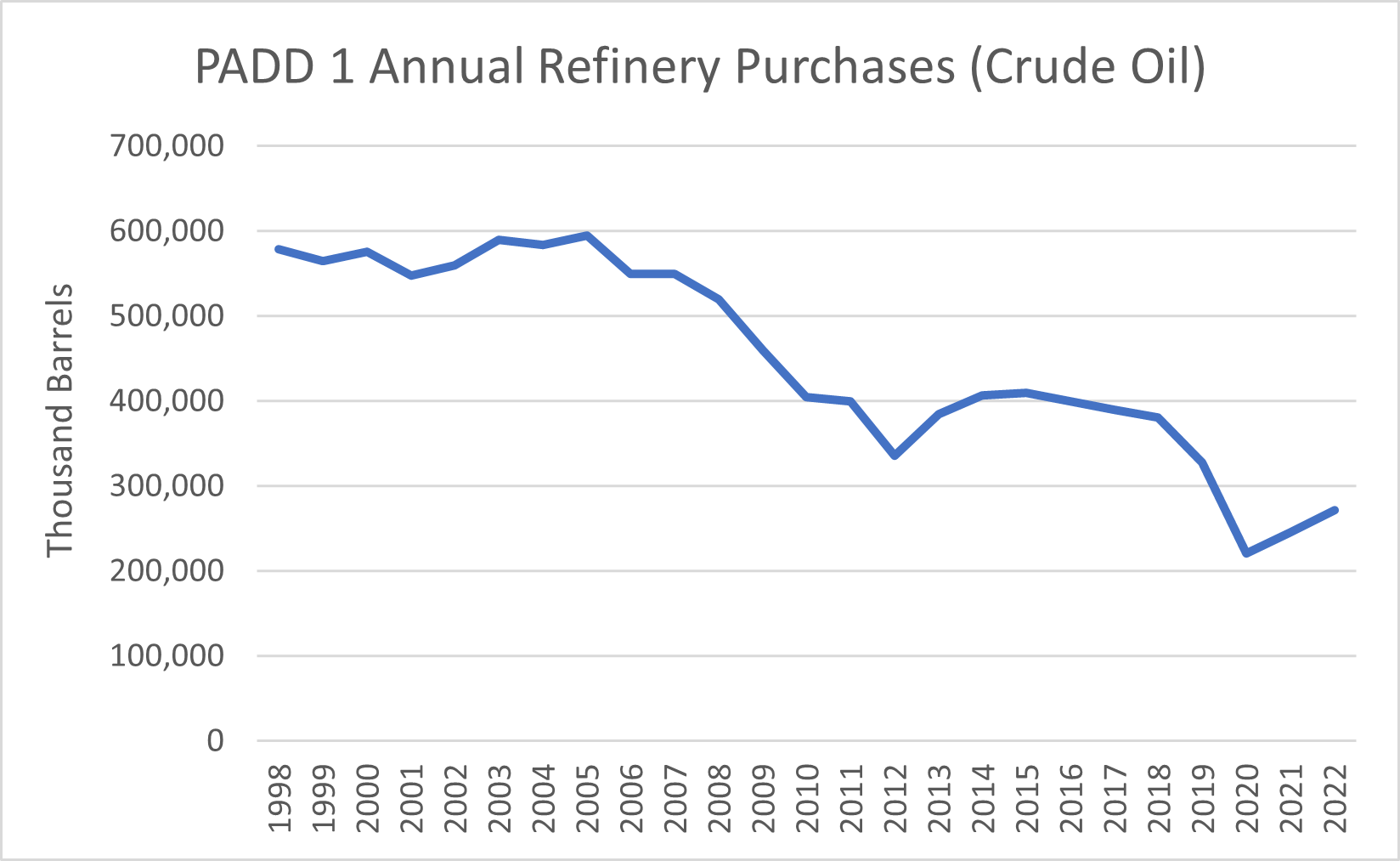

Infrastructure is a necessary condition for market creation and Canada and the United States are intimately connected by a pipeline and rail network that supports a North American market for heavy crude. Canada exported roughly 3.7 million barrels of oil per day in 2023 with nearly 97% of all exports going to the United States2. Destinations for Canadian oil exports are often US refineries in the Midwest and Gulf Coast. Exhibit 1 shows Canadian oil exports in average barrels per day over time by destination using data from the Canada Energy Regulator (CER).

Exhibit 1 – Canadian Oil Exports by Destination

Source: CER

Canada’s dependence on the US as a consumer of heavy crude, particularly in PADD 2 and PADD 3, is a risk for oil sand producers in the long term. At the refinery level, the choice between domestic and foreign crude would be made for cost, product specific, and reliability reasons. Historically, US refiners have employed the largest kit of heavy oil processing capability in the world3. Maintaining, idling, or reconfiguring this equipment is inherently part of a cost benefit analysis American refiners make. Price differentials between heavy and light crude and low cost, reliable transmission have tilted the calculation towards maintaining heavy oil configurations but is not guaranteed in the future. Capital expenditures today will dictate the pathway by which Canadian oil producers must navigate in the future.

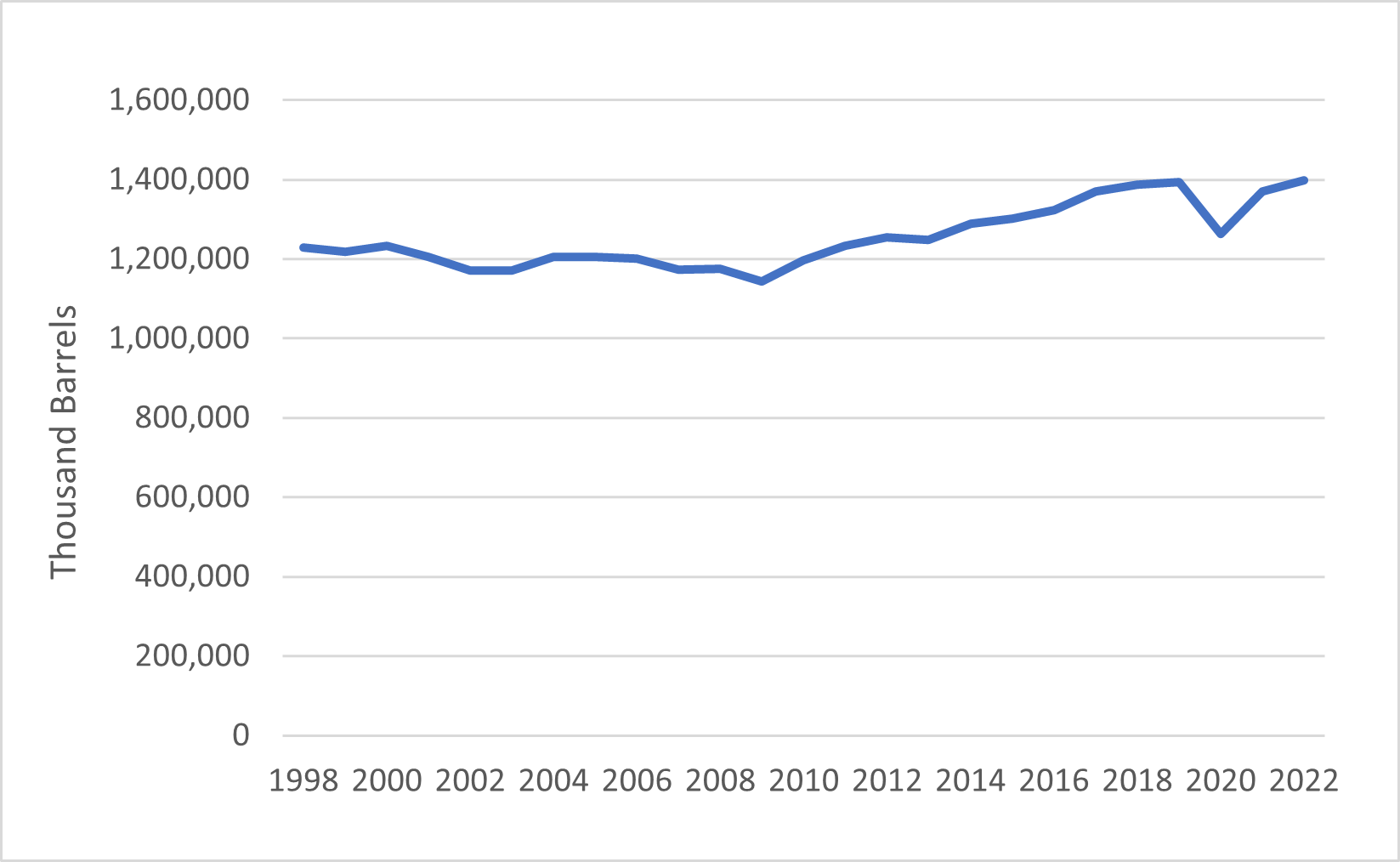

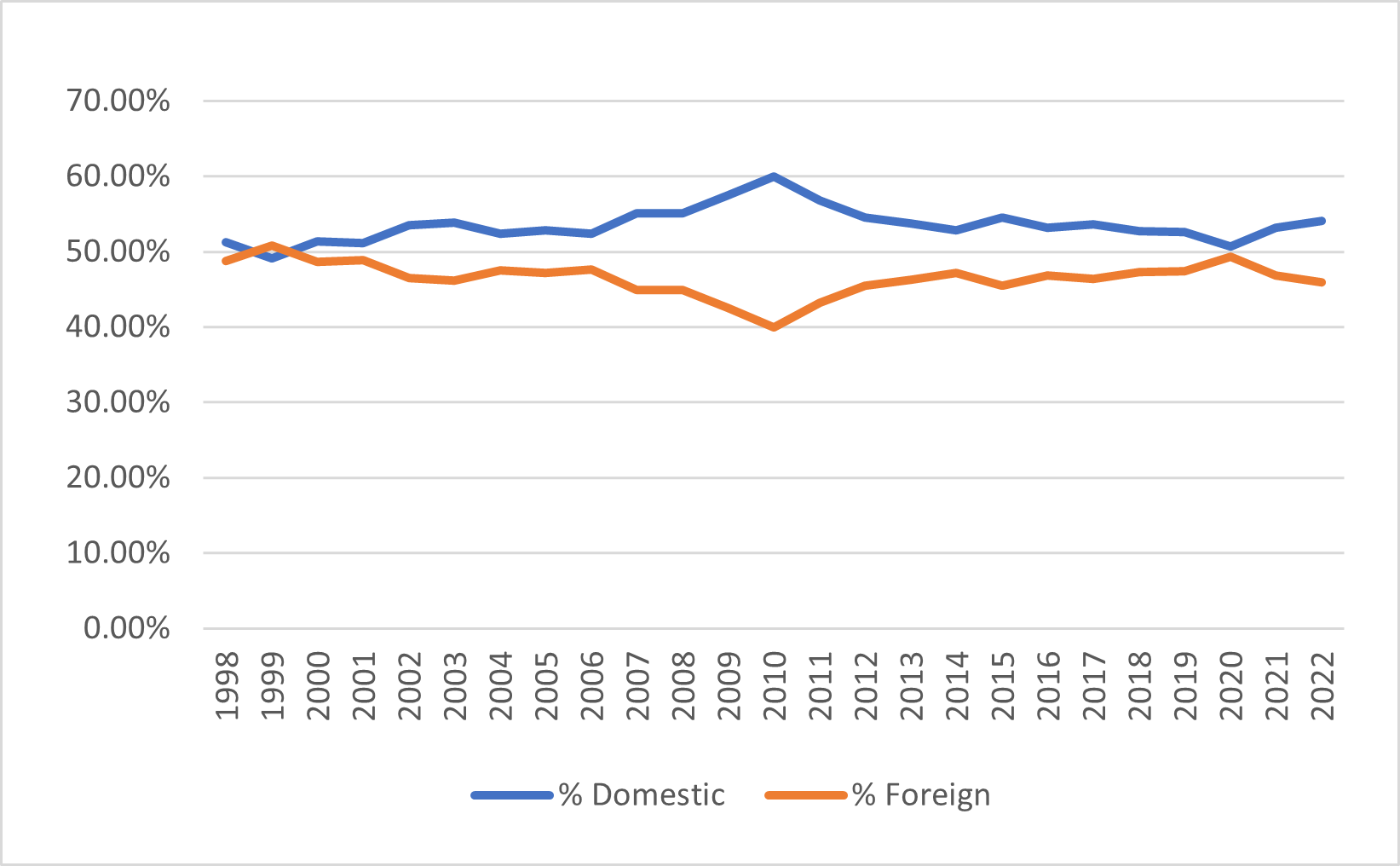

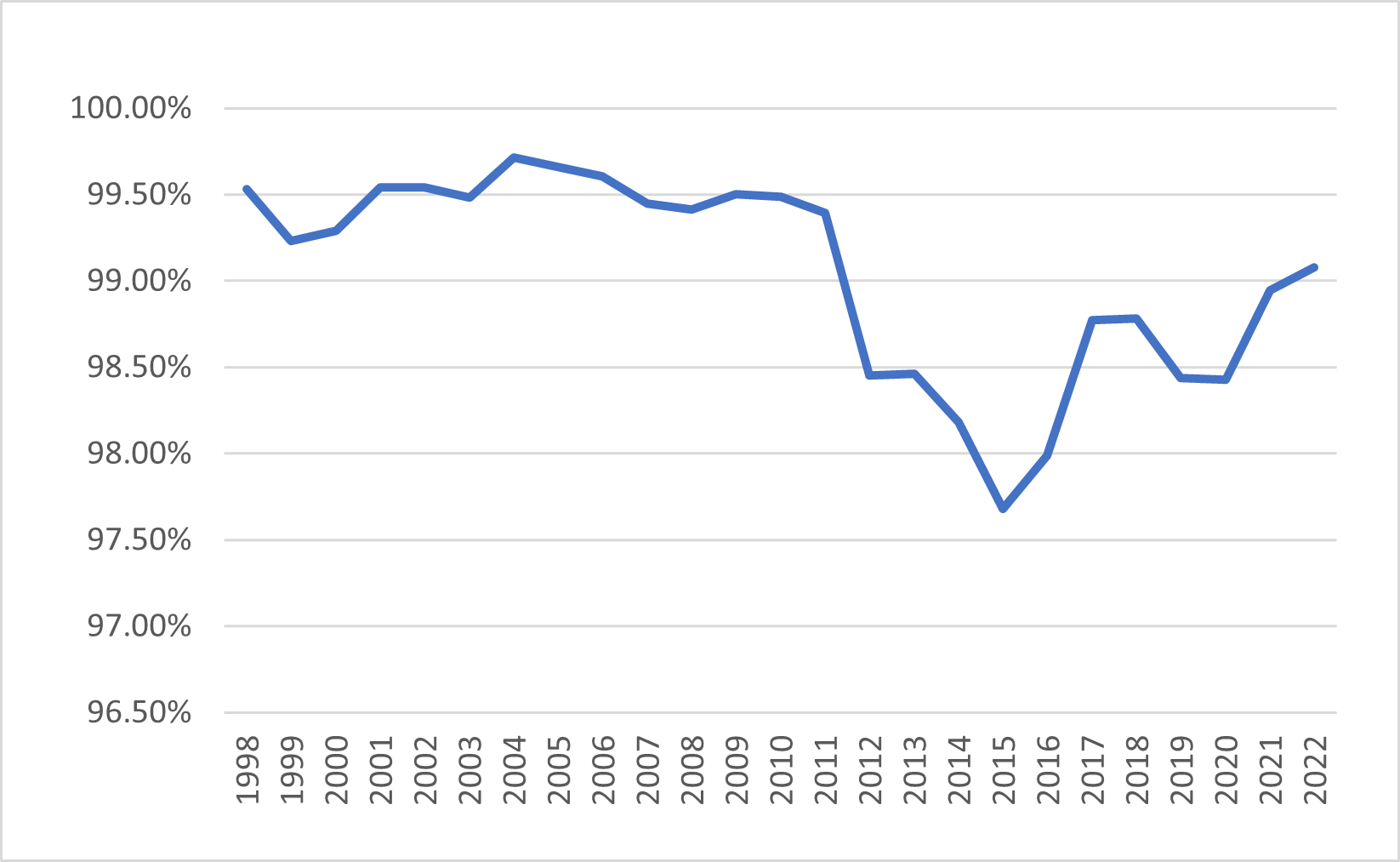

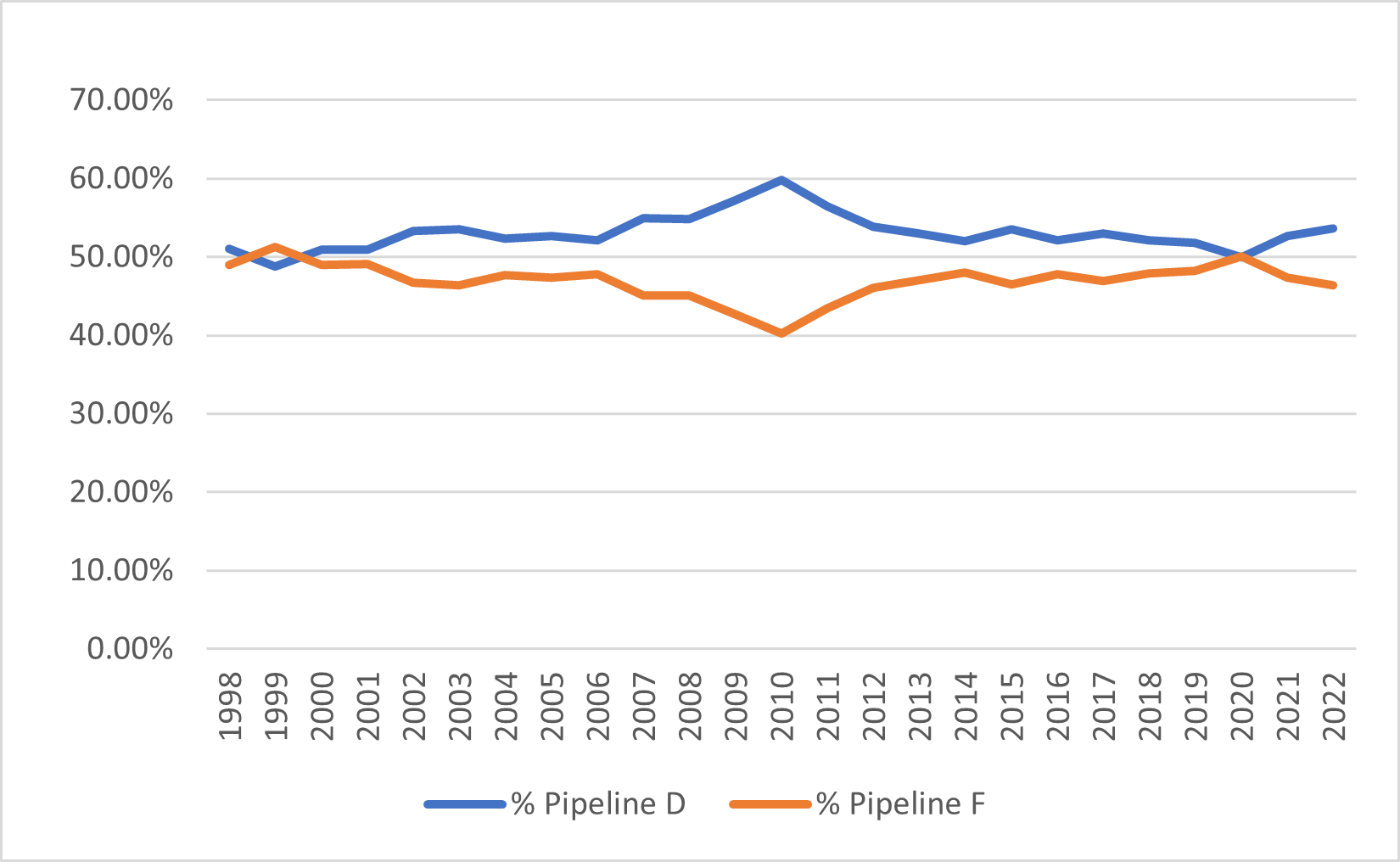

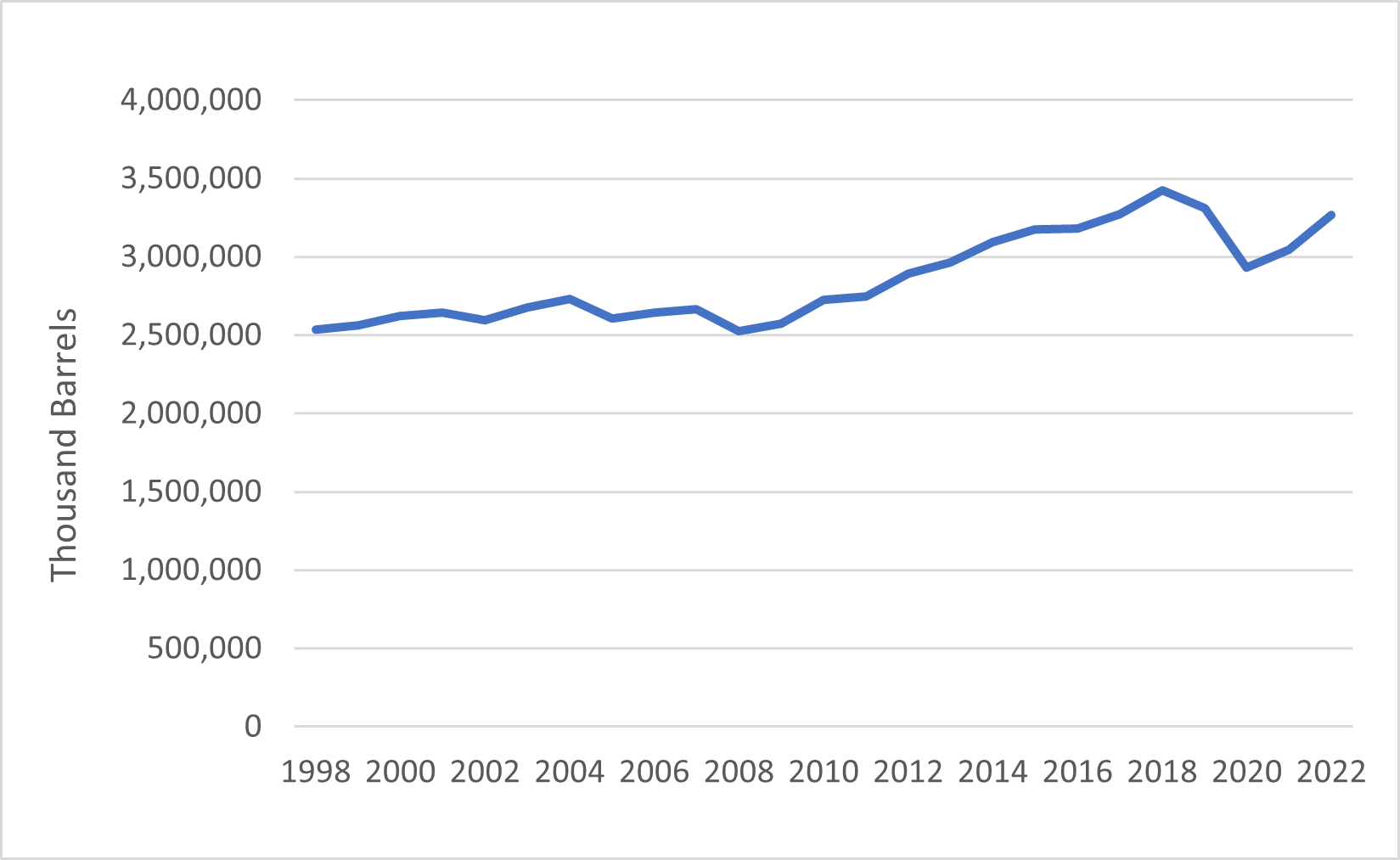

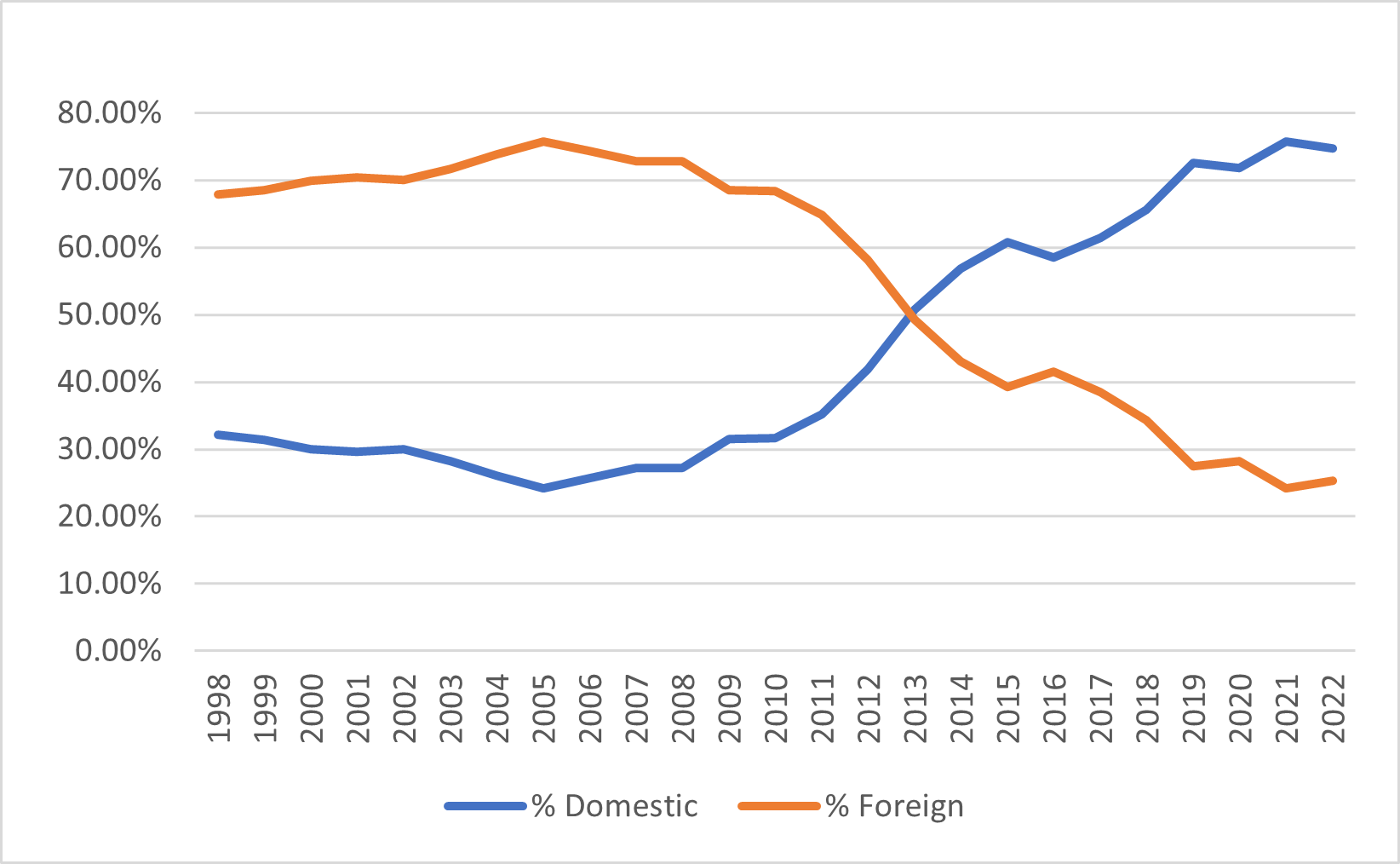

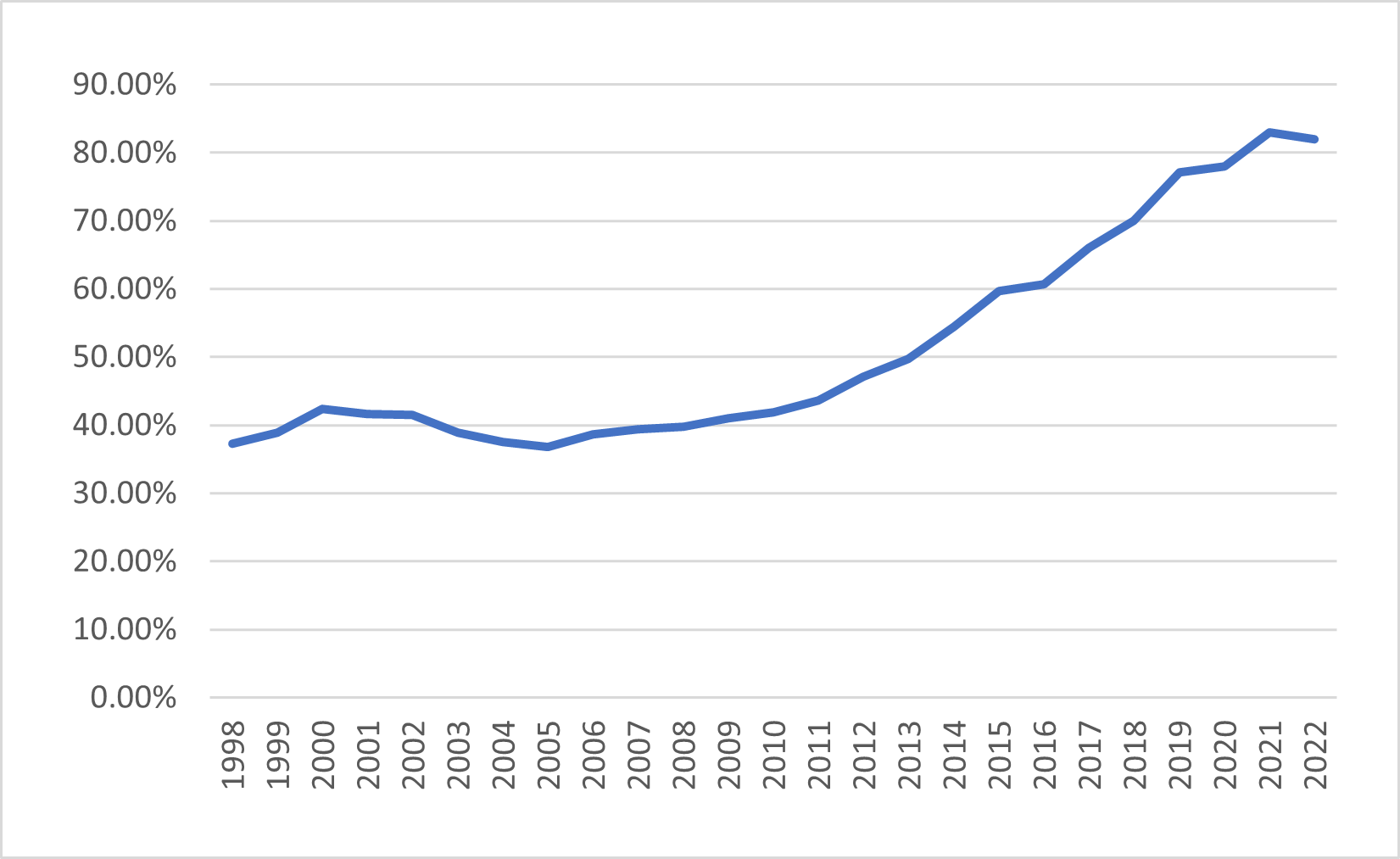

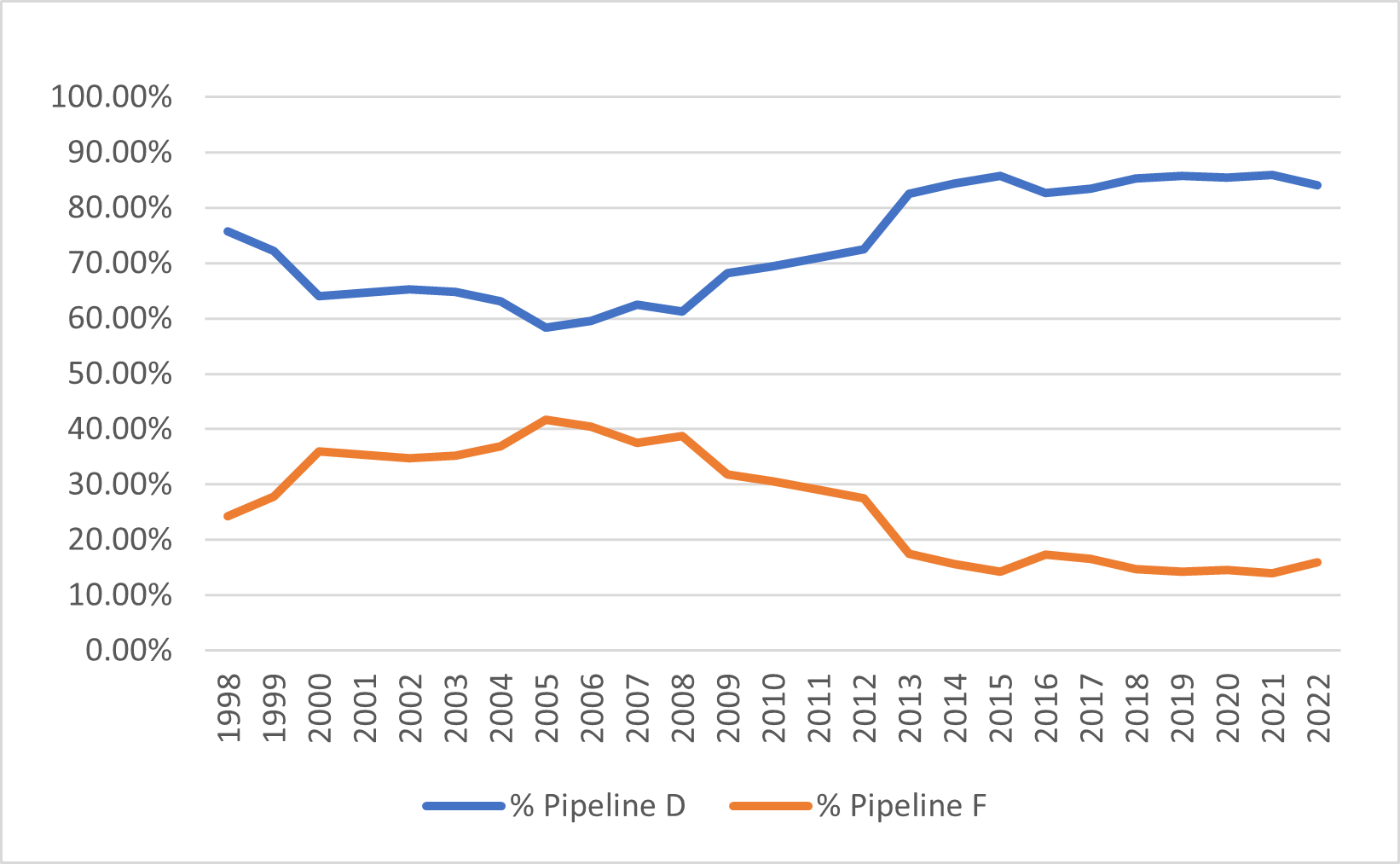

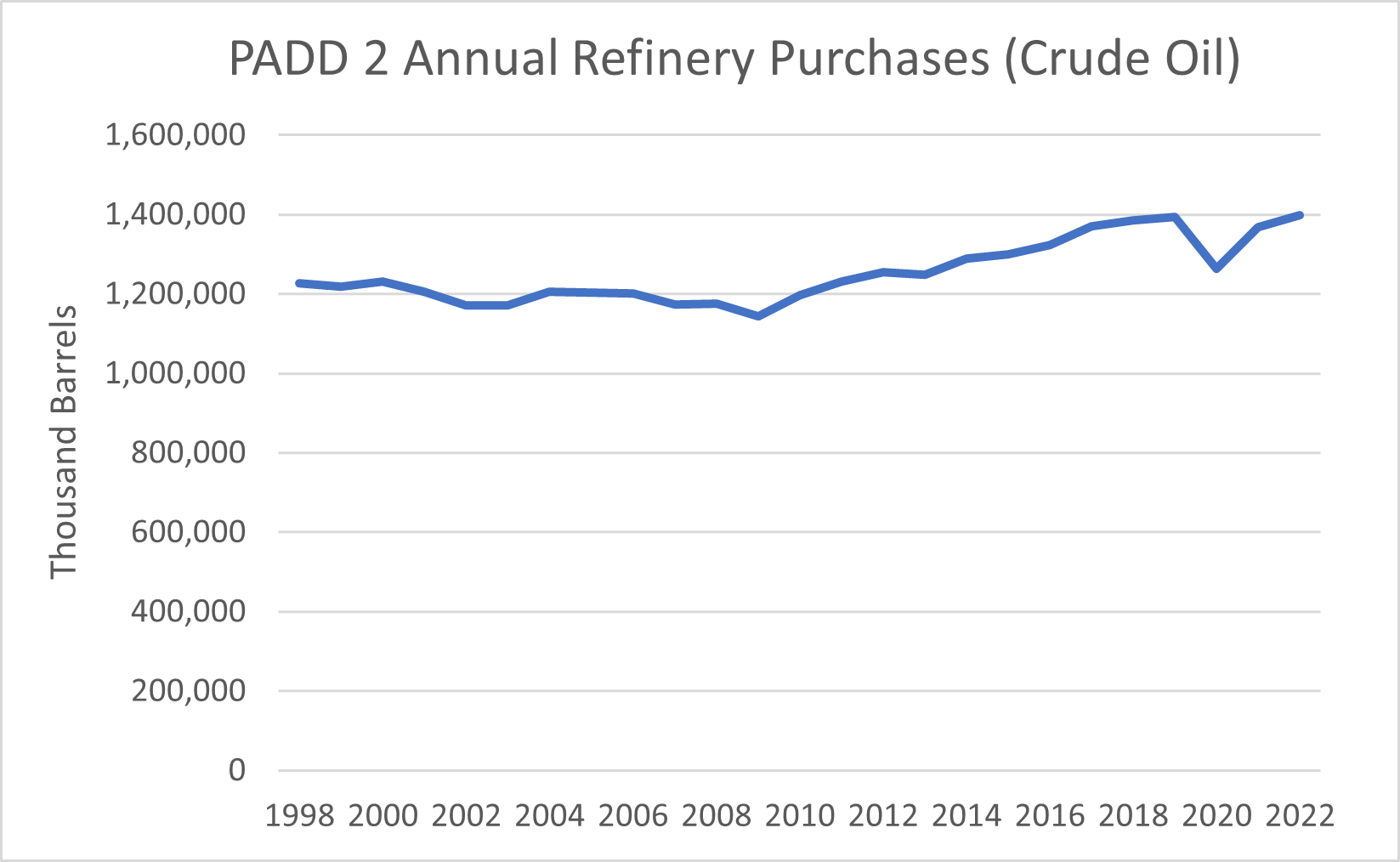

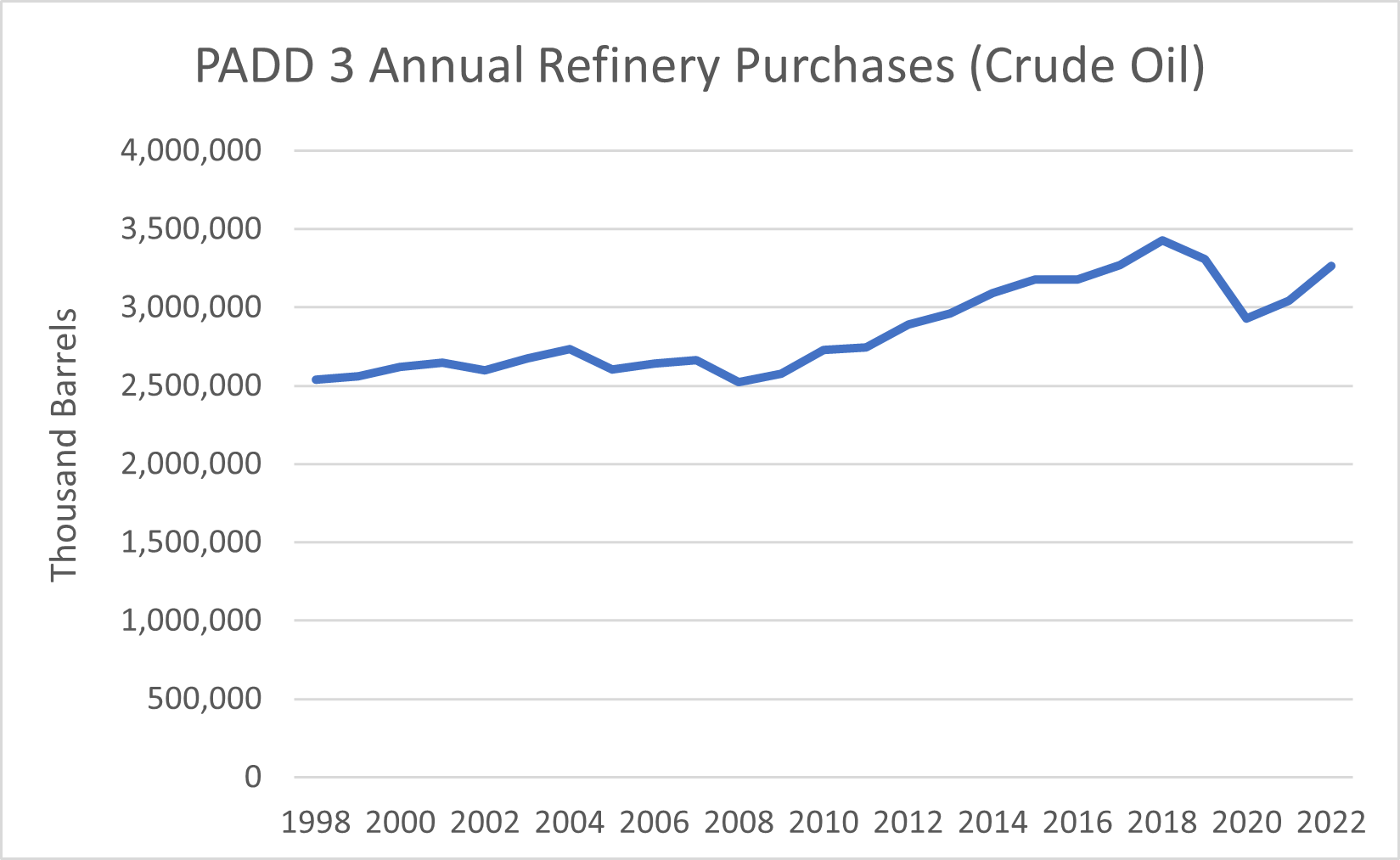

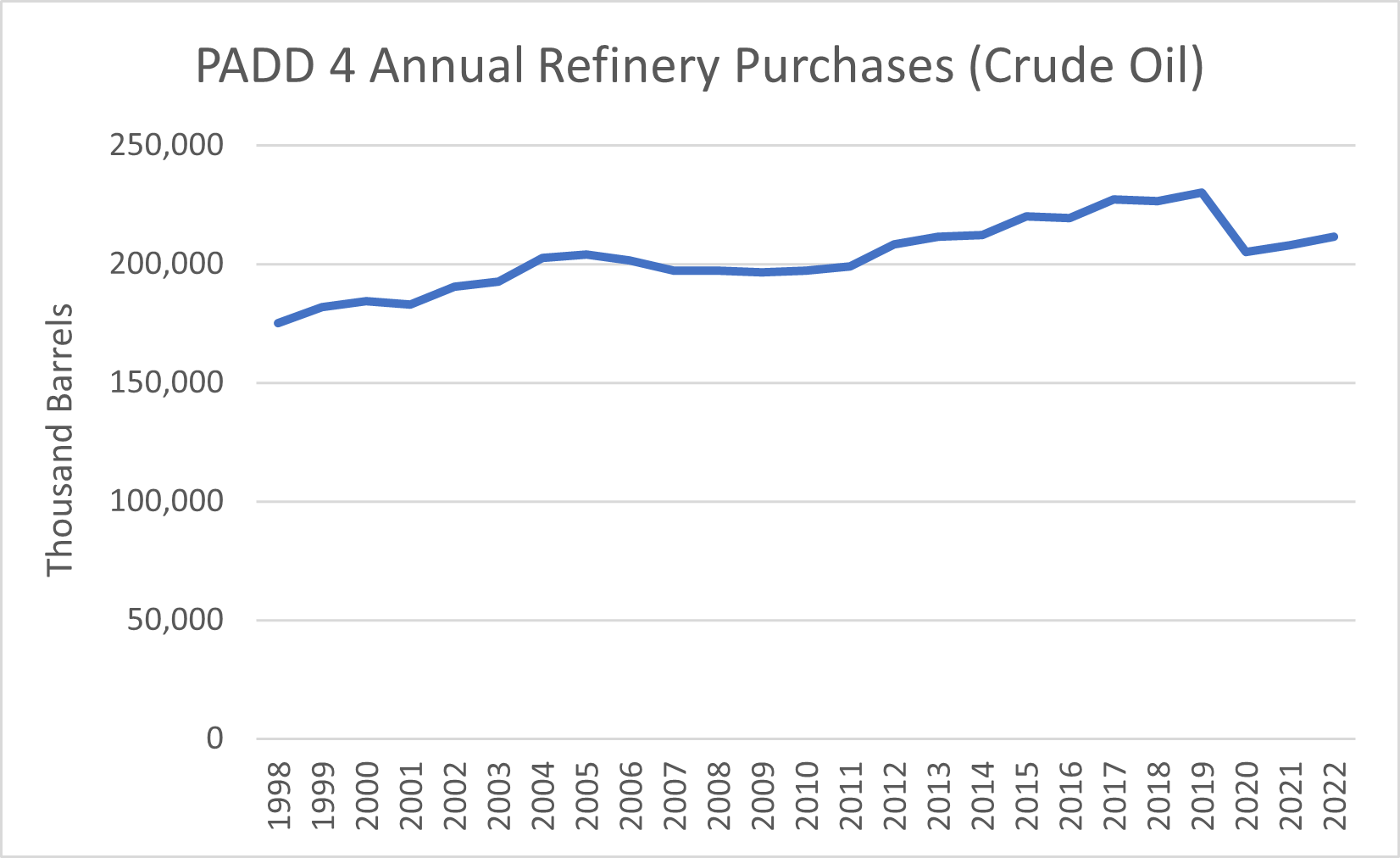

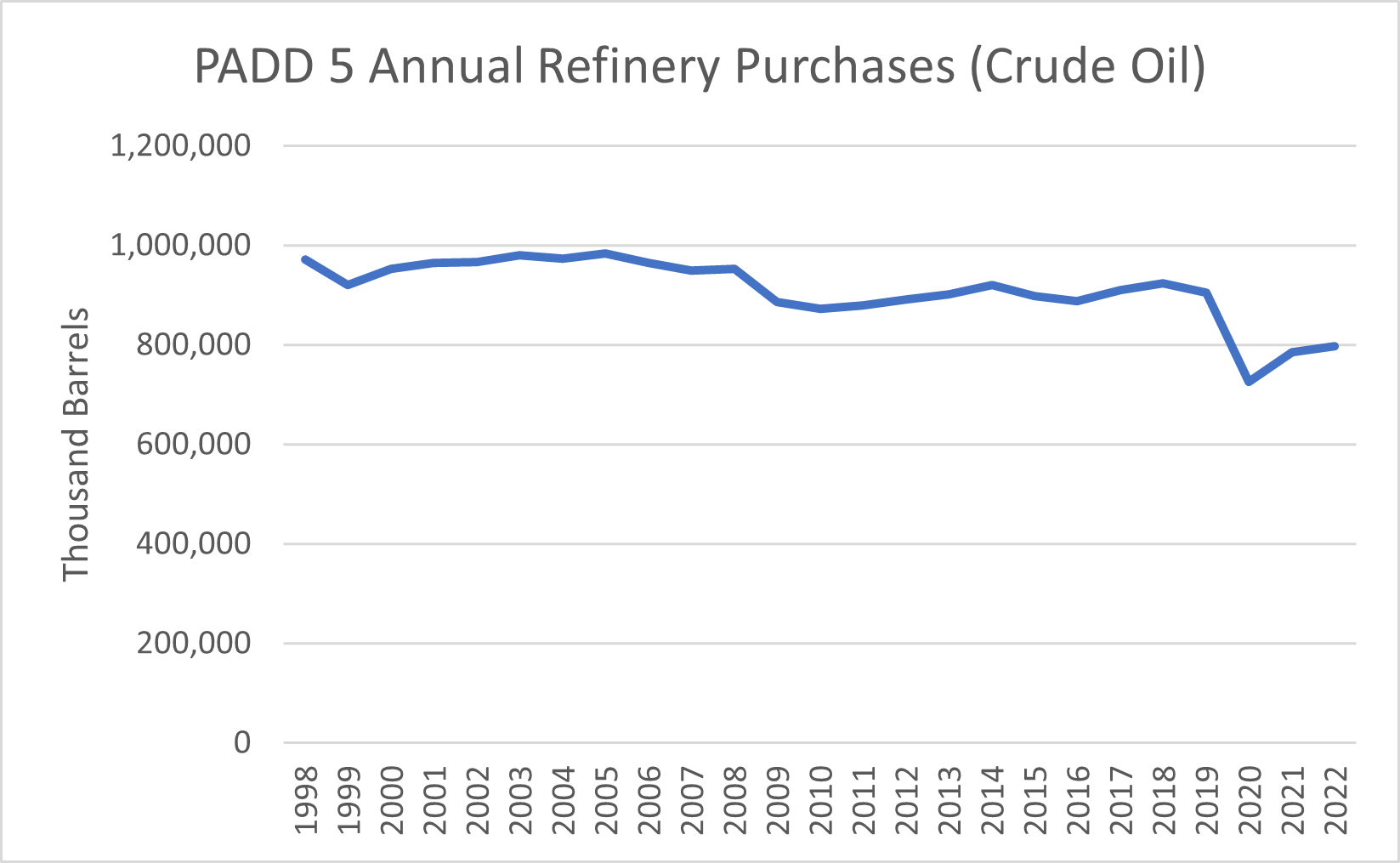

Looking at the consumption decisions of American refineries from PADD 2 and PADD 3 is enlightening. Exhibit 2 and 3 show total annual purchase volumes, composition of total purchases (foreign/domestic), percentage delivered via pipeline, and composition of pipeline receipts (foreign/domestic). PADD 2 and PADD 3 account for 23% and 55%, respectively, of all US refinery receipts in 20224. Over the past 20 years PADD 2 and PADD 3 have accounted for nearly all US refinery receipt growth. The remaining three PADDs have a combined net negative growth over the same period5.

Exhibit 2 – PADD 2 Refinery Receipts (Crude Oil)

Total Annual Receipts

Composition of Total Annual Receipts

Annual Receipts Transported via Pipeline

Composition of Pipeline Receipts

Source: EIA

Exhibit 3 – PADD 3 Refinery Receipts (Crude Oil)

Total Annual Receipts

Composition of Total Annual Receipts

Annual Receipts Transported via Pipeline

Composition of Pipeline Receipts

Source: EIA

On aggregate American refineries have turned to domestic oil to satiate growth. Canadian oil export growth has, in fact, occurred, but as foreign oil becomes a smaller share of the US refining feedstock, oil sand producers are capturing a market share of a shrinking foreign oil pie. For example, on the Gulf Coast Canadian heavy oil has served as a replacement for heavy crude imports transported via tanker. The decline of foreign crude as a percent share of PADD 3 refinery receipts aligns with an increase in domestic pipeline purchases and a decline in foreign tanker deliveries to the Gulf Coast. Growth in overall crude demand from PADD 2 and 3 refiners is supporting increased levels of Canadian crude production.

Diversification of Buyers

Diversification of buyers would insulate oil sand producers from US purchasing power and infrastructure to facilitate this decoupling has arrived. The Trans Mountain Expansion Project provides Canadian producers a low-cost pipeline option to deliver oil to Pacific and Asian markets. The previously maligned project has promised increased exports of crude oil to the Pacific coast by as much as threefold6. Ahead of the Trans Mountain pipeline’s opening, price differentials between Western Canadian Select (WCS) and Cold Lake Select (CLS) relative to West Texas Intermediate (WTI) narrowed in anticipation of offtake optionality for oil sand producers.

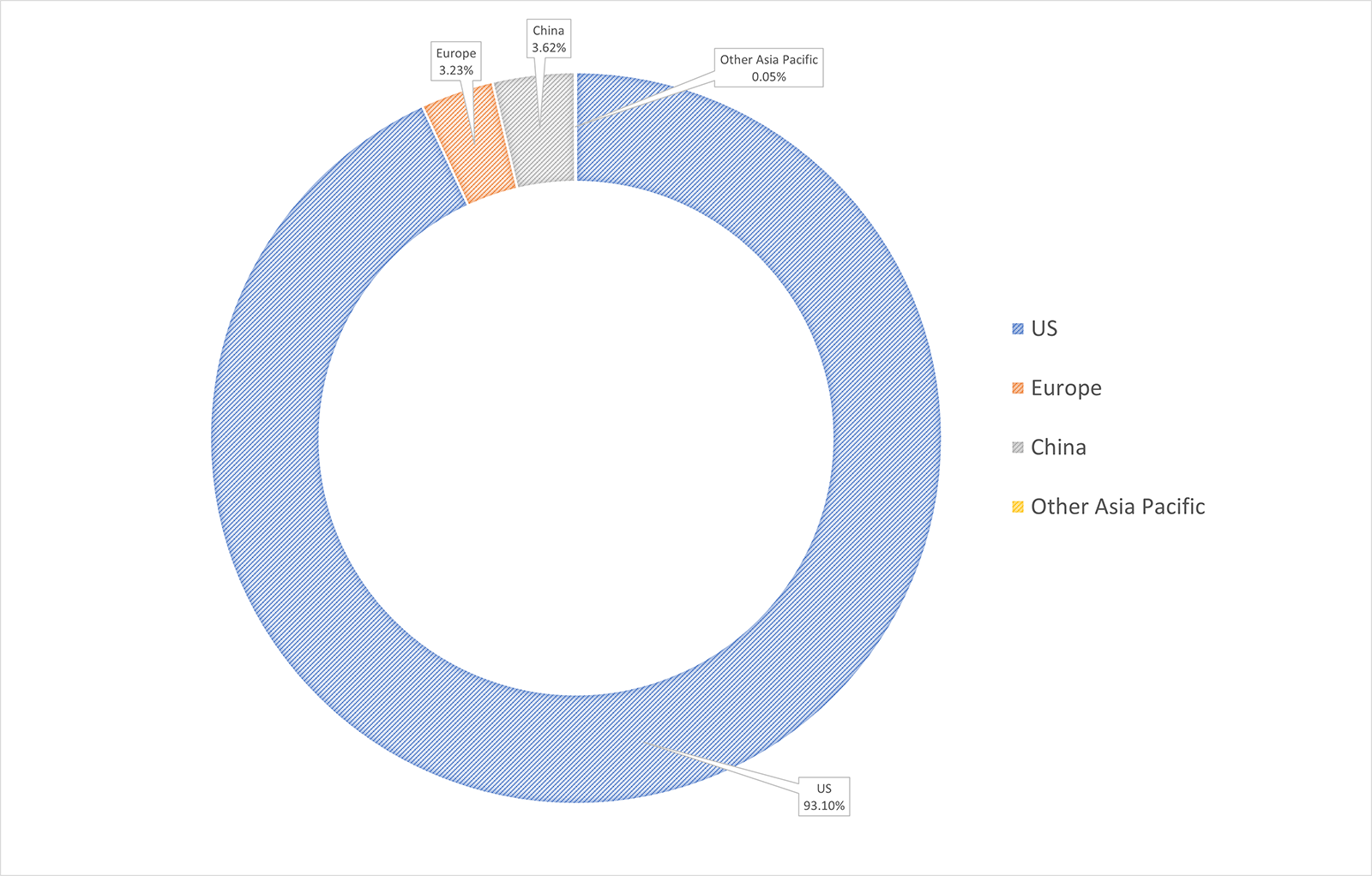

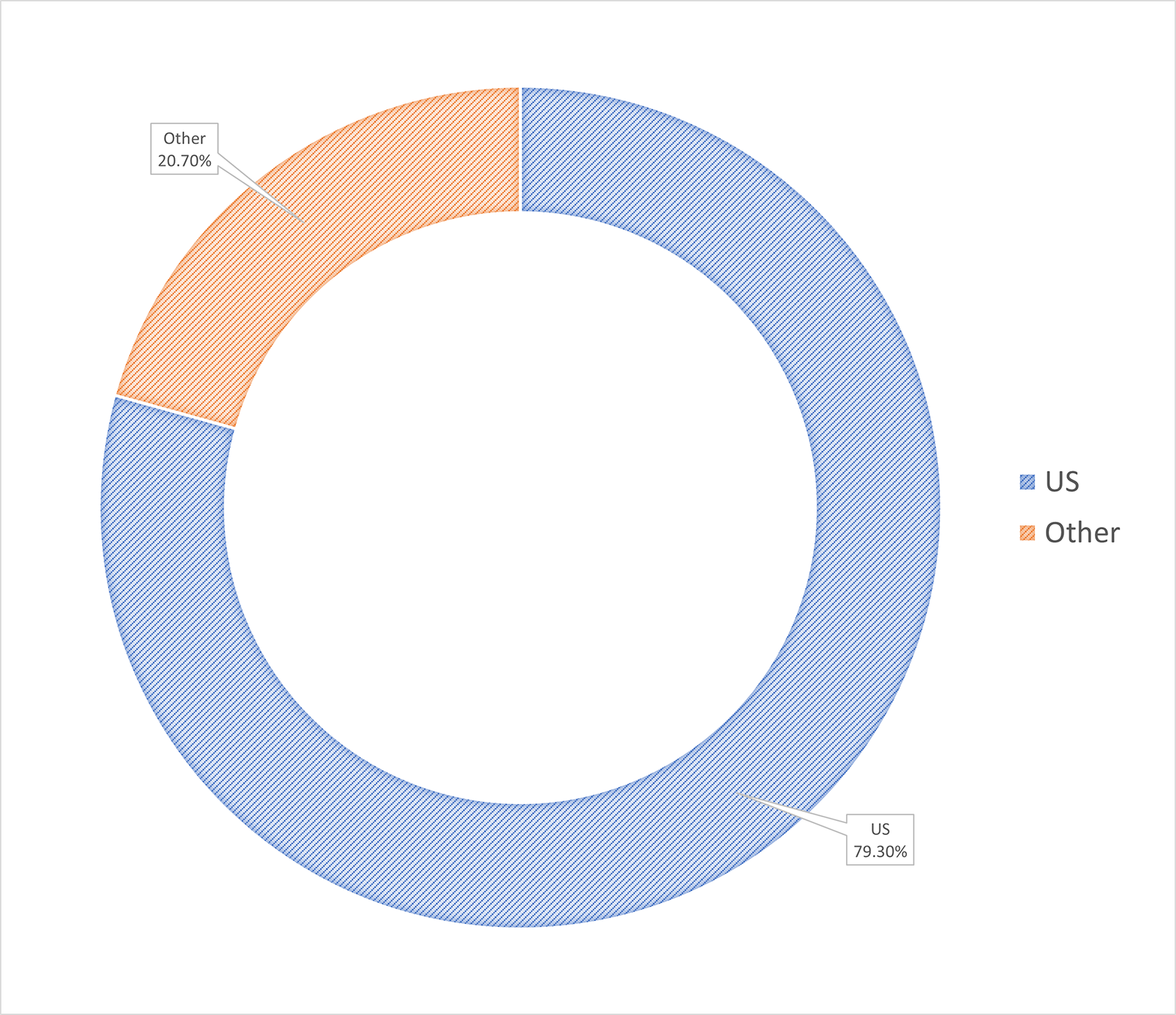

The newfound ability for Canadian producers to access Indian, Chinese, and other Asian markets is welcomed, but limitations may still apply. Exhibits 4 and 5 show the current state of crude exports by destination and a hypothetical scenario in which non-US crude exports triple. Exhibit 5 perhaps even overstates the impact of the Trans Mountain Expansion project by tripling all current non-US exports (i.e., 6.9%). This includes destinations outside of Asia.

Exhibit 4 – Crude Exports by Destination (2023)

Source: 2024 Statistical Review of World Energy7.

Exhibit 5 – Theoretical Crude Exports by Destination

Source: Author.

India and China are likely the buyers oil sand producers hope will support the offtake of the Trans Mountain Pipeline expansion. India is poised for oil demand growth into the medium term as the country continues to develop. China on the other hand may not be the purchaser Canadian producers anticipate. Electric vehicle (EV) demand is strong in China and is posited to stagnate domestic oil demand.

There is perhaps a chance the two nation’s frugality would attract them to discounted Canadian crude exports. Both countries have demonstrated their willingness to purchase sanctioned oil because of its heavy discounts. For example, China’s largest supplier of foreign oil in 2023 was Russia8. Regardless, even under maximum utilization of the Trans Mountain Pipeline expansion Canadian oil producers will still be dependent on US demand. In the most generous of scenarios, it is difficult to foresee non-US exports reaching levels of 25% of total exports.

Geopolitics

Rising global competition could also shape import and export strategies. Energy security concerns shape policy decisions and are another pathway that could support the longevity of oil sands producers. Geography, the need for reliable liquid fuels, and the vast interconnection between the countries’ oil industries makes for a natural partnership between Canada and the United States. The strategic interest of this North American alliance and the development of policy in the name of energy security would likely benefit and prolong oil sands production.

Challenges should not go unnoted though. Both the United States and Canada have commitments to decarbonize their economies and the inability of oil sands operators to reduce their carbon footprint could inhibit long term viability, regardless of the strategic value of the resource. Furthermore, oil sands are not the only source of crude oil on the continent, and the threat of tariffs from the United States poses risk. Oil sand producers rely on US refiners and the depth the US oil market provides. It is conceivable to imagine a world where WCS and CLS trade at a steep discount to compensate for tariffs and transportation fees, much to the dismay of Canadian producers. In a world of tariffs, oil sand producers will find little recourse in the short to medium term. They are beholden to the monopsony-like power of US buyers.

It is unclear how Canada will attempt to alleviate pressures of a US tariff scheme, but it is difficult to make long term investment decisions on short-term political actions. Evolving policy decisions and variable geopolitical relationships will certainly have an impact but it is unclear what the repercussions will be a priori.

Conclusion

In examining the long term viability of oil sands production, the path ahead is uncertain. Competition from state-owned, low-cost producers, climate action, and adverse investment environments will make it difficult for oil sands producers to remain viable. The United States’ ascension as an oil producer and shifts in trade policy makes the outlook seem even more challenging. Investment in infrastructure, diversification of buyers, and energy security policies perhaps offers a roadmap for long run viability. Simply put, Canadian oil production benefits from reducing US monopsony-like power over the oil sands export market and disciplined capital investment.

With ten hubs on four continents, capSpire is positioned to help clients operate and grow, no matter where they are or where they’re going. To learn more about our wealth of expertise in Canadian energy and commodities markets, connect with Caleb.

Appendix

Endnotes

- Natural Resources Canada. (2024). Energy Fact Book 2024 – 2025

- Natural Resources Canada. (2024). Energy Fact Book 2024 – 2025

- S&P Global Ratings. (2020). https://www.spglobal.com/ratings/en/research/articles/200228-for-the-western-canadian-select-differential-rail-reigns-11351175

- U.S. Energy Information Administration. (2023). https://www.eia.gov/dnav/pet/pet_pnp_caprec_dcu_nus_a.htm

- U.S. Energy Information Administration. (2023). https://www.eia.gov/dnav/pet/pet_pnp_caprec_dcu_nus_a.htm

- Trans Mountain. (2024). https://www.transmountain.com/project-overview

- Energy Institute. (2024). 2024 Statistical Review of World Energy.

- CNN. (2024). https://www.msn.com/en-us/money/markets/china-s-largest-oil-supplier-in-2023-was-russia/ar-BB1h3Apd