So what’s happening in Ireland’s electricity market? Well, in May 2018 the current electricity market, the Single Electricity Market (SEM), will cease to exist and it will be replaced by the Integrated Single Electricity Market (I-SEM).

Two immediate questions spring to mind. Firstly, why the change? Secondly, what are the main features of this new electricity market?

The answer to the first question is reasonably straightforward in that the current electricity market in Ireland (the SEM) does not comply with EU internal energy market legislation, hence the need for a market redesign. In recent years, there has been a move at a European policy and legislation level to integrate electricity markets into a single pan-European electricity market. (At this stage, policy aficionados would interject and explain how the push for integration has largely been driven by congestion-management guidelines, which deal with the allocation of cross-border interconnector capacity)[1]. In this scenario, each individual market will have its own name (in Ireland, it’s the I-SEM), but all the markets will be interlinked.

What are the main features of this new electricity market (the I-SEM)?

The main commercial change is that suppliers (companies that provide electricity to their residential and industrial customers) and wind generators can trade in the market. If they decide not to participate in the various markets (day ahead and intra-day), then they may be exposed to potentially punitive (or less favorable, from a generator’s perspective) balancing market prices.

The other major change relates to the introduction of a day-ahead market in which electricity generators, financial traders, and suppliers can position their portfolios at the day-ahead stage. The electricity market price, which generators and suppliers get matched, and cross-border electricity flows will be decided by a European-wide algorithm called EUPHEMIA. The aim of the algorithm is to maximize social welfare. One way that it achieves this is by ensuring that electricity flows from low-priced regions to higher-priced regions until either the interconnection capacity is congested or until the prices in the regions match.

In short, a whole new set of market participants need to be thinking about trading and hedging strategies. There will also be a number of traded markets, one of which will be fully determined by the EUPHEMIA algorithm.

Now for the interesting bit!

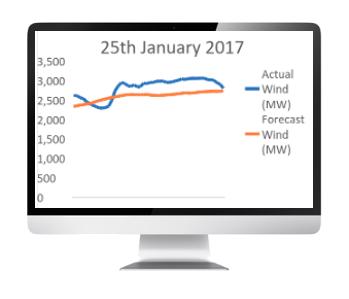

All of this is happening in an environment in which renewable energy, primarily wind generation, is becoming an increasing feature of the electricity mix in Ireland. As an example, take January 25, 2017. According to the Irish Wind Energy Association, and as seen in the graph below, renewable generation met a record proportion of system demand that day.

[1] An interesting aside relates to the recent momentous Brexit vote. The European legislation referenced above primarily deals with the allocation of cross-border gas and electricity capacity. The key point here is that the cross-border element refers to internal EU borders, or the capacity between two interconnected EU jurisdictions. With Britain leaving the EU, Ireland would only have gas and electricity capacity connections with an external jurisdiction, and hence, arguably, the current electricity market arrangements (the SEM) would not be in breach of EU guidelines.

A few observations can be made from these graphs:

- Price formation. With a high and reasonably constant level of wind over the day, the shadow price (a proxy for a generator’s production cost) remained relatively stable. Even with increasing wind penetration, thermal generators (namely gas and coal) will still set the marginal price; albeit, this marginal price will face downward pressure as less efficient, and hence more expensive, thermal generators are needed less and less to meet system demand.

- Wind forecasting. If wind generators start actively trading the market, then their forecasting and modeling capabilities (the accuracy of their forecast versus their actual production) comes into play. How confident are these generators in their forecasts? How quickly can they process the information? Are there counterparties to trade with and which windows do they trade in? These are some of the questions that market participants, and not just renewable generators, will need to consider.

Now the pièce de résistance!

In the current electricity market (the SEM), all liquidity is concentrated in one timeframe. In the new electricity market (the I-SEM), unless there is a sudden influx of new market and trading participants, the same liquidity is likely to be split between three timeframes: day-ahead, intra-day, and balancing markets.

The other factor that will influence price formation in the new market (the I-SEM) is an impending policy decision relating to a renewable support scheme called REFIT (per a recent public service obligation levy publication, approximately 2.8 GW of renewable generation is subject to REFIT in 2016 and 2017). The policy decision will clarify how financial support for these renewable generators is calculated in the new market. This is likely to have a significant influence on which markets renewable generators participate in the I-SEM.

The impact?

At a guess, the two aforementioned factors may lead to less liquid markets and more volatile wholesale prices.

What is clear, given the opportunities and risks, is that market participants will allocate more resources on their modeling and forecasting capabilities. The ability to quickly process data (forecast system wind data, forecast system load data, etc.) and subsequently submit trade orders to the market will be of paramount importance.

At capSpire, we are actively engaged with a number of clients and vendor partners in developing and implementing robust technology solutions for the I-SEM. Our unique blend of technology and functional expertise encompassing trading, risk, and data analytics make us well placed to deliver innovative solutions that are on time and on budget, but above all, that deliver value for our clients. For more information about how capSpire can help your organization, email info@capSpire.com.

[1] An interesting aside relates to the recent momentous Brexit vote. The European legislation referenced above primarily deals with the allocation of cross-border gas and electricity capacity. The key point here is that the cross-border element refers to internal EU borders, or the capacity between two interconnected EU jurisdictions. With Britain leaving the EU, Ireland would only have gas and electricity capacity connections with an external jurisdiction, and hence, arguably, the current electricity market arrangements (the SEM) would not be in breach of EU guidelines. capSpire is a global consulting and solutions company that solves difficult business and technology problems for commodity-focused organizations. It provides the unique combination of industry knowledge and business expertise required to deliver impactful business solutions. Trusted by some of the world’s leading companies, capSpire’s team of industry experts and senior advisors empowers its clients with the strategies and solutions required to effectively streamline business processes and attain maximum value from their supporting IT infrastructure. For more information, please visit www.capspire.com.

*System load and wind data for January 25, 2017 are sourced from www.eirgrid.com, and market prices for January 25, 2017 are sourced from www.sem-o.com.

About capSpire