No one wants to leave money on the table, right?

And yet, many fuel retailers with high volumes of rack purchases eventually encounter a similar issue: potentially overpaying. Furthermore, they have no accurate, time-saving means of:

1) Verifying that payables are drafted appropriately for the correct volume and value

2) Correcting discrepancies between internal calculations and vendor payables

3) Analyzing and resolving problems by addressing their root cause

Any discrepancies, disagreements, or misinterpretations on lifted products and pricing by either party—especially those identified a few months after the transaction—can be a nightmare to track and resolve.

Why?

- Suppliers often draft their customers for rack liftings. As a result, payable corrections happen after liftings have already been paid, leading to a cumbersome and lengthy credit and re-bill process.

- Disagreements with suppliers regarding products, prices, volume, and taxes can be difficult to track across suppliers and often get ignored without a verification process for payables drafted by vendors.

- Difficulties in matching truck liftings to correct sales contracts can cause disagreements on product price.

Compounding this challenge is the more than 400 rack terminals in the U.S., with a huge number of suppliers at each location. With this network size and complexity, in addition to the high volume of transactions, it’s next to impossible to manage payables manually unless your company has a massive account payables team. In today’s market, it just doesn’t make sense to have your people verifying volume by truckloads manually.

As it turns out, payables are easy and straightforward—until they aren’t.

Why CTRM?

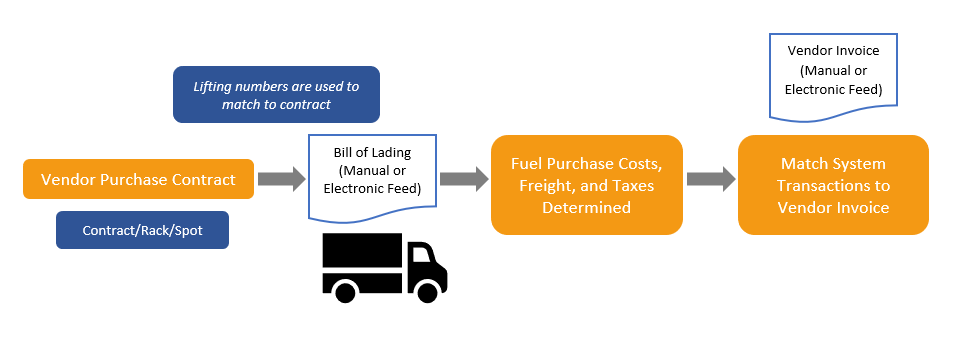

Operational accounting is best managed through a commodity trading and risk management (CTRM) system. When configured properly and interfaced with other internal systems and vendor systems correctly, a CTRM system can automate accounting payables matching. Meaning, the system can transfer vendor invoices and bills of lading (BOL) from product liftings at the terminal into an electronic format—using a data transmission network—and automatically match them with deals in your system containing pricing information. Users don’t have to get involved in this process unless there’s an exception.

When this is done well, it can be an absolute game changer.

Lessons Learned: CTRM Solutions for Account Payable Issues

From our extensive work with fuel retailer clients in implementing CTRM systems to address these pain points, we have identified three key lessons learned:

- Automate payable processing as much as possible, leaving manual intervention for exceptions.

Maximum system automation not only conserves employees’ time and company resources, but it significantly reduces the potential for human error, improves accuracy, eliminates points of friction, and prevents lengthy dispute and credit processes.

Example of the accounts payable workflow that can be enhanced by system automation:

- Creation of invoices

- Receipt of payables and bills of lading (BOLs) via a data transfer network

- Confirmation that the correct contract is used for payables (especially true if a company uses both term and spot agreements with a supplier)

- Matching payable line items to purchaser’s calculations to avoid scenarios in which purchasers pay invoices without first confirming the accuracy of all charges

- Verification that all payables drafted are within a tolerance of what the purchaser believes they should pay

- Flagging invoices with discrepancies for manual review as soon as possible so that invoices can be disputed with suppliers prior to the drafting of funds

- Address payables issues at the source.

Whether it’s a vendor data error, misinterpretation of a contract, or an internal system issue causing inaccurate transactions for a specific location, it’s vital that accounts payable groups uncover the source of problems.

To do this, your company must have a process for identifying the source of problems in the first place and figure out why they’re happening. This can be achieved through a trend analysis or root-cause analysis.

The right technology paired with CTRM expertise can assist with troubleshooting. For example, capSpire’s Payable Workbench tool brings payable data together efficiently to enable faster problem-solving. This tool gives users multiple options for grouping, viewing, and assessing data, such as listing information by carrier, supplier, or terminal.

By engaging in this analysis, all truckloads going forward can be billed correctly and prevent further manual effort by the team whenever possible. After all, you don’t want to fix the same issues repeatedly.

- Create clear and consistent processes (that are also as automated as possible) in case of issues.

These processes include:

- A “triage” process for resolving issues (which may involve non-accounts payable groups, such as the front office or tax groups, depending on the issue)

- A dispute process with suppliers

- A credit and rebill process

Interested in learning more about how the right CTRM system—optimized for your company’s needs—can prevent costly issues and help your business run more efficiently? At capSpire, our team of consultants brings a wealth of experience working with fuel retailer clients as well as our CTRM expertise. For more information, please contact Laura Bevilacqua, Managing Consultant, at laura.bevilacqua@capspire.com.