Recently, hundreds of professionals in the natural gas liquids (NGL) industry gathered at the OPIS NGL Summit in Phoenix, Arizona. This is the annual conference that brings together the majority of the industry in one place to set up contracts, network, and attend educational sessions. From these presentations and conversations with attendees emerged distinct themes about the current state of the industry:

1. The U.S will remain the largest propane exporter and the benchmark for global pricing for the foreseeable future.

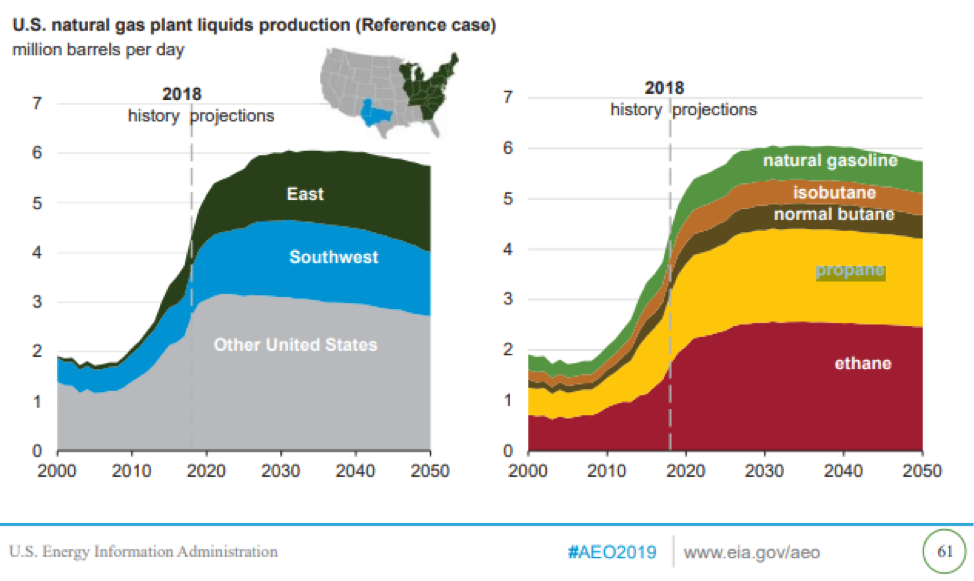

In 2019, U.S production growth of NGLs is expected to continue at the 2018 annual growth rate of 600,000 BPD over the year. This growth rate is expected to slow to 300,000 BPD in 2020. More than 50% of propane production is now being exported and virtually all the incremental supply over the next few years will be exported. As propane exports grow, Mont Belvieu will become increasingly important in setting global prices. Today, Mont Belvieu is the global price benchmark. Prices in Northwest Europe and East Asia (major importers) are expected to remain at a premium to Mont Belvieu, approximately equivalent to freight.

2. NGL marketers value a highly diversified supply portfolio to mitigate risk.

A key lesson learned from last year’s issues mobilizing rail cargoes from Edmonton is that propane and butane marketers, wholesalers, and retailers need to diversify their supply options. Propane contracts that are delivered at a terminal (DAT) can be sourced from anywhere, so it may be worthwhile for buyers to investigate the supply sources of counterparties and carefully examine the Force Majeure clause.

There are many potential supply locations in the U.S and Canada. However, evaluating the storage fees and transport costs (via pipeline, truck, and rail), incorporating the forward curve, and running multiple scenarios, are time-consuming and highly manual. capSpire has developed a cloud-based supply-chain-planning tool that helps marketers optimize their supply and contracting decisions. This solution has helped NGL organizations save time, increase margins, and reduce risk in their supply chains.

3. There will be price weakness in the global propane market between 2020 and 2025, with absolute propane prices tracking crude prices but at a steeper discount.

The balancing of additional propane supply from the U.S. has been primarily driven by additional demand from China. Between 2020 and 2025, an oversupply is expected in the global propane market, which will cause international arbs to become scarce and propane prices to fall in terms of their price as a percentage of crude oil. Beginning in 2025, the market is expected to rebalance as NGL supply plateaus.

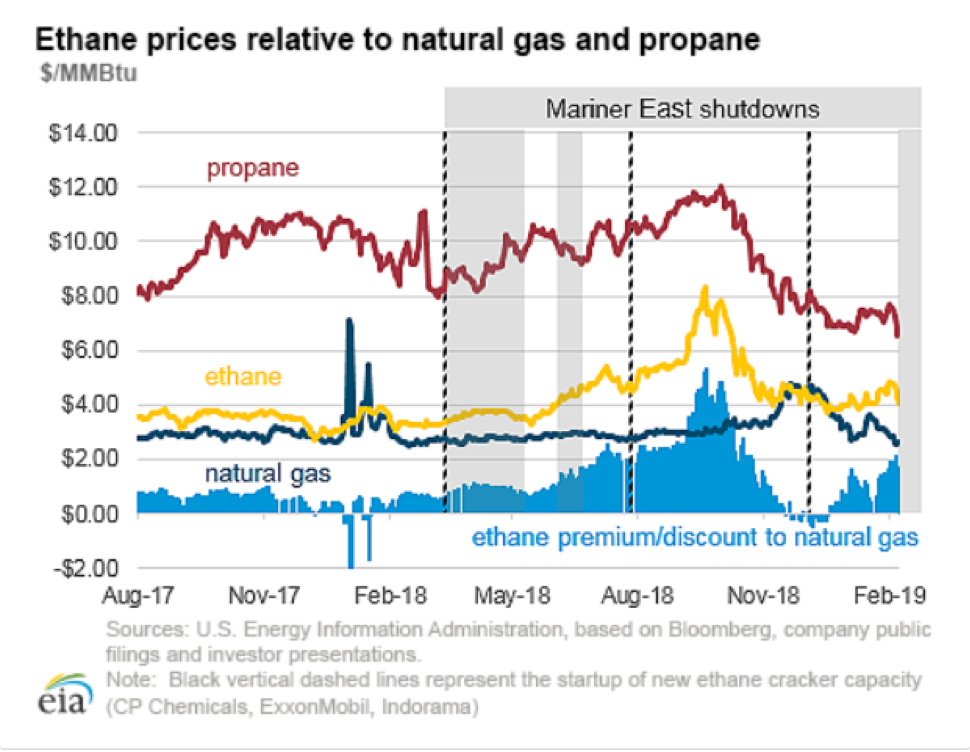

4. New ethane crackers and export capacity will keep the price of ethane at a healthy premium to thermal value for the foreseeable future.

Between 2013 and 2018, ethane prices closely tracked the prices of natural gas, leaving little incentive to recover it from the NGL stream. The addition of new ethane crackers and export facilities along the Gulf Coast and in the Northeastern U.S. (significant ethane-producing regions) has increased the structural demand for ethane. As such, prices are expected to remain at a healthy premium compared to the price of natural gas, which will lead to more ethane being recovered for cracking and exports. The graph below illustrates the natural gas and ethane price divergence, which started in March 2018.

5. Canadian exporters of liquid petroleum gas (LPG) have significant cost advantages when shipping to East Asia, with the additional benefit of no import tariffs to China (which is 25% for U.S-origin product).

Companies such as AltaGas and Petrogas are leveraging their proximity to a cheap and abundant supply of propane as well as their strategic location just across the Pacific from high-value Japanese, Chinese, and Korean markets. U.S cargoes bound for East Asia have to pay the hefty Panama Canal toll and sail an additional 4,000 nautical miles (roughly twice the distance). In addition, U.S.-originated propane attracts a 25% tariff in China, which adds to the cost disadvantages. Interestingly, Canadian-origin propane shipped from U.S. terminals, such as Ferndale, Washington, is exempt from the 25% tariff. Canadian exports are low in volume relative to U.S. exports but could prove to be a high-margin business, especially if freight rates rise and the Edmonton-Belvieu spread stays wide.

6. The operational status of Mariner East, Mariner East 2, and Mariner East 2X pipelines will impact the opportunities for propane-by-rail operators in the Marcellus/Utica in 2019.

Bottlenecks in the liquids-rich Marcellus/Utica plays caused regional spot NGL prices to plummet starting in April 2018. Delays getting Mariner East 2 online and intermittent shutdowns with the existing Mariner East pipeline left propane and other NGLs stranded in the Northeastern U.S. This presented an opportunity for marketers to purchase cheap supply and ship it via railcar. More volatility in 2019 could present similar opportunities, with the most recent Mariner Pipeline shutdown occurring in January 2019.

7. Propane retailers face a shortage of truck drivers and the average spot freight rate increased by 20% in 2018.

The average age of truck drivers in the U.S. is 55. More drivers are retiring than are entering the industry, partly because of the perception that driverless trucks will eventually phase out the need for human operators. As such, the trucking industry faces a severe shortage of drivers, which is pushing up salaries and freight costs. The retail propane business is not immune to this trend and has been forced to allocate more resources to secure drivers.

8. The Canadian NGL industry faces a unique challenge: Margins have been compressed because of geographic isolation, infrastructure shortages, and increased competition from U.S. producers.

The Canadian oil and gas veteran, Geoffrey Cann, recently published a book called Bits, Bytes, and Barrels: The Digital Transformation of Oil and Gas. This book uses Canadian examples to highlight the impact of changes that have occurred in the oil and gas sector as a whole over the last few years. Driven by the shale revolution, supply, and productivity are increasing while demand and costs have decreased. This has lead to a more constrained market in which margins are shrinking, particularly for Canadian operators who face higher production and transportation costs. The energy industry used to dominate the rankings of the largest companies in the world. Now that list is dominated by technology companies. Cann’s prediction is that a technological revolution will sweep through the oil and gas sector over the next five years.

Large oil and gas organizations have paved the way toward this technological revolution by using advanced analytics, optimization, cloud computing, machine learning, and blockchain technologies to stay competitive. capSpire is at the forefront of this revolution by developing solutions to serve increasingly complex and constrained markets and through our optimization solutions and consulting services. Whether or not you were able to meet any capSpire team members at OPIS this year, we would love to discuss your business and how we can help. Please contact us at info@capspire.com.

|  |

capSpire provides the unique combination of industry knowledge and business expertise required to deliver impactful business solutions. Trusted by some of the world’s leading companies, capSpire’s team of industry experts and senior advisors empowers its clients with the business strategies and solutions required to effectively streamline business processes and attain maximum value from their supporting IT infrastructure. For more information, please visit www.capspire.com.

About capSpire