In our last blog, we explored the impact of refinery shutdowns on the macro supply and demand of crude in regional hubs such as Midland. We also explored how refiners and midstream operators are increasingly leveraging optimization technology to help them manage their lease crude obligations during refinery shutdowns and turnarounds.

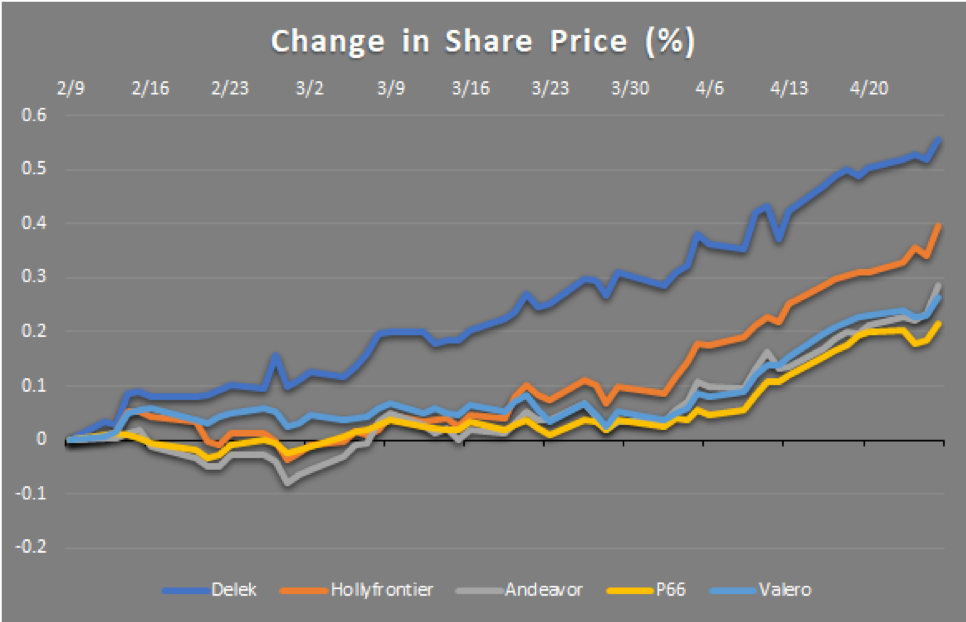

In this blog, we will explore how the limited takeaway capacity in the Permian and the return of the Brent-WTI differential is benefiting some independent refiners. The graph below illustrates how the share prices of a group of independent refiners have diverged since mid-February when expectations about the increasing Midland-Cushing (Mid-Cush) price spread started to gather momentum. The trend for all the refiners listed in the graph is upward, but to different extents depending on their relative exposure to the Brent-WTI differential and the Mid-Cush differential. Delek and Hollyfrontier have outperformed their larger contemporaries due to their exclusive reliance on domestic crude.

The physical location of a refinery generally determines its exposure to a particular price for the crude that it consumes. In the U.S, most coastal refineries are considered to be exposed to the Brent price, whereas inland refineries tend to be more exposed to differentials to the WTI price. This is because coastal refineries are primarily fed by waterborne crude that is priced at the international Brent price. On the other hand, inland refiners tend to source more crude from domestic production, which is based on the WTI price.

Today, the WTI-Brent spread is sitting at -$7.00, and futures contracts suggest that this will continue for the foreseeable future. The Midland-WTI Cushing price differential is hovering at around -$12.00, and futures contracts suggest that it will remain at this level until mid-2019.

So what does all this mean?

Depending on their locations, U.S refiners are paying very different prices for their crude supply. As such, independent refiners with a large proportion of their crude priced at the Midland and WTI discounts are benefiting from cheap feedstocks, and this is reflected in their share price. Delek and Hollyfrontier are two small inland refiners set to benefit significantly from their strategic locations close to the prolific Permian and Anadarko Basins.

While this trend is set to continue for the next year or two, the only constant in the oil business is change. Andeavor and Phillips 66, Plains, Energy Transfer, and Epic are all planning new takeaway capacity from the Permian, so the current market conditions will not last long. As such, forward-looking refining companies are using this short-term fortune as an opportunity to rationalize their supply chains to reduce costs and ensure they are well positioned to deal with whatever the future holds.

capSpire combines unrivaled energy expertise with a proven track record of developing and implementing supply chain optimization software, which is helping our clients minimize costs and identify opportunities at every part of the value chain, from the wellhead to the refinery gate.

For more information about capSpire’s supply chain optimization system, please contact info@capspire.com.

|  |

capSpire provides the unique combination of industry knowledge and business expertise required to deliver impactful business solutions. Trusted by some of the world’s leading companies, capSpire’s team of industry experts and senior advisors empowers its clients with the business strategies and solutions required to effectively streamline business processes and attain maximum value from their supporting IT infrastructure. For more information, please visit www.capspire.com. About capSpire